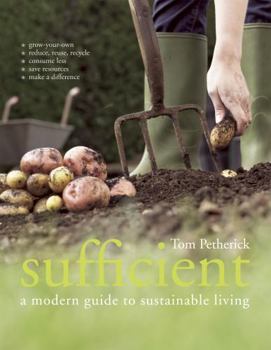

Sufficient: A Modern Guide to Sustainable Living

Select Format

Select Condition

You Might Also Enjoy

Book Overview

A global shift has begun that is slanted towards slowing down and consuming less, embracing artisan foods, and championing human-scale organic growing methods that are safe, compassionate, and pleasurable. This comprehensive reference is designed to inspire, educate and encourage a process of change towards a simple, gentle, and sustainable way of living.It features a passionate approach to understanding why changes need to be made and how they can be achieved in a fun and life-enhancing way, and highlights in particular ways to grow organic vegetables and fruits or raise animals in almost any setting. Its central aim is to encourage the practice of sustainability in every aspect of life."

Format:Paperback

Language:English

ISBN:0143116177

ISBN13:9780143116172

Release Date:October 2009

Publisher:Penguin Books

Length:496 Pages

Weight:0.89 lbs.

Dimensions:1.2" x 5.5" x 8.4"

Age Range:18 years and up

Grade Range:Postsecondary and higher

More by Colleen Evans

Customer Reviews

12 customer ratings | 7 reviews

There are currently no reviews. Be the first to review this work.