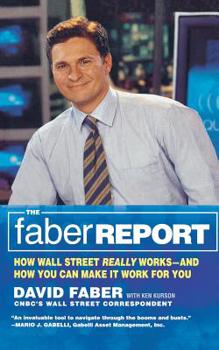

The Faber Report: How Wall Street Really Works-And How You Can Make It Work for You

Select Format

Select Condition

Book Overview

These days, when CNBC's David Faber talks, Wall Street listens. Unlike the talking heads that populate the financial news channels, Faber is a down-and-dirty investigative reporter. For six years, on CNBC's popular Squawk Box and in his own segments, Faber has broken story after story. Each day over one million people tune in to hear his daily report. Those who know the score know that Faber is the one to listen to -- especially now that the market isn't doing as well as it used to. Now Faber has written the smartest, most innovative investment book to be published in years. Like Harvard Business School's famous case study method, each chapter is built around a story -- the story of how a stock was presented to the public. Then Faber extracts clear, easy-to-follow lessons and instructions on how readers can learn the stocks real story, just as he does everyday on CNBC. Readers learn not just how to pick the stocks they want to invest in, but how to avoid joining the "penguins" lining up for big losses. The Faber Report combines practical, down to earth investment advice with wild accounts of investor fraud, company misdeeds, and famous investors and banks that have led investors astray. A quantum leap beyond the usual investment books, The Faber Report is essential reading for anyone who wants to profit-bulls or bears.

Format:Paperback

Language:English

ISBN:0316164925

ISBN13:9780316164924

Release Date:October 2003

Publisher:Little Brown and Company

Length:292 Pages

Weight:0.65 lbs.

Dimensions:0.8" x 5.4" x 8.3"

Age Range:13 years and up

Related Subjects

Business Business & Investing Economics Introduction Investing Personal Finance StocksCustomer Reviews

4 ratings

Something For Everyone

Published by Thriftbooks.com User , 22 years ago

Decades from now, when historians want to get a better understanding of what Wall Street was like at the turn of the 21st century, they won't need to look much further than The Faber Report. Faber's book paints an amazingly clear and comprehensive picture of today's investment climate, giving the reader gobs of insight into the inner workings of the Street.The book has something for everyone; whether you're a novice investor trying to navigate the world of mutual funds or a hedge fund manager with a penchant for short selling, you'll find it eminently useful. (And if you happen to be the New York state attorney general looking for a blueprint to prosecute Jack Grubman and the rest of Wall Street, you'll find the book very worthwhile!) While the book covers investing basics with exceptional clarity (it has a paragraph on the P/E ratio that is one of the best I've seen), it also contains some headier material that more sophisticated investors will find helpful (his 12 point checklist for uncovering financial shenanigans is a keeper). It's difficult to write a book that is both entertaining and instructive, but Faber has pulled it off in spades.

The Brain's the best there is!

Published by Thriftbooks.com User , 22 years ago

There's no one better in the world of financial reporting than David Faber. As a member of the media, I could only wish to be as connected, informed, and intelligent as he is. But most importantly, he's the best there is when it comes to sifting through the b.s. that has plagued Wall Street over recent years. This book is almost uncanny, in that it was written months before the dominant financial headlines that rocked the markets in the summer of 2002. We get the warnings about Worldcom, Imclone, and so on, well before anyone else does. Plus, he tells the reader where they can find raw data, what to look for, and the signs that a stock is trouble. Not really a "How to Invest" book, but rather, a "How to Be Informed" book. This book is a must-read. Faber tells it like it is. He was right in the 1990s when he warned on CNBC about the over valued Internet stocks, and time proved him right. By reading this book, you'll understand what to look for the next time Wall Street starts blowing a bubble.

Marketplace entertainment

Published by Thriftbooks.com User , 22 years ago

This hook is filled with funny, fascinating, and fantastic stories from the world of business and Wall Street and is worth buying for that alone. The analysis is fragmented however and the advice of limited usefulness, e.g. I'm not sure how many investors need help in choosing a hedge fund.Buy it for the amusement value.

A pleasure and a (painless) education

Published by Thriftbooks.com User , 22 years ago

This is the kind of book on Wall Street I have waited years for. First, the writing is terrific; too rare a treat in books on stocks and markets. Second, the anecdotes and examples, while highly instructional, can stand alone as exciting tales - you needn't even be interested in Wall Street to find much of this material fascinating. And if you are interested in Wall Street - even if you're a regular Joe who's a little intimidated by markets, as I am - the book goes a long way toward helping you tap into the Street savvy you've long suspected was necessary to even the score. A first-rate effort.